RWA Tokenization

Jurisdictions, Сosts, Regulations 2026

Real-world asset tokenization converts ownership rights in tangible assets into blockchain-based digital tokens. The on-chain RWA market reached about $35 billion by late 2025 and is projected to grow to $2–16 trillion by 2030. This guide explains the key legal frameworks, jurisdictions, structures, and steps for launching compliant RWA projects.

RWA Tokenization Packages & Pricing

Essential

For early-stage teams that need the legal concept and token model only

- Regulatory & token classification memo (MiFID II / MiCA / US tests)

- Token & project structuring (jurisdiction, SPV / fund / token model)

- Core token legal documents (Token Terms, White Paper, Subscription)

- Smart-contract & technical architecture advisory

- SPV / issuer incorporation in chosen jurisdiction

- Compliance & AML / KYC framework (policies, investor onboarding)

- Primary issuance support (investor flow, documentation, delivery)

- Multi-jurisdiction legal opinion (EU / US / offshore)

- Custody & banking setup (custodian, EMI / bank accounts)

- Secondary market & 6-month post-launch support

Standard

For projects ready to set up an SPV and run the first compliant issuance

- Regulatory & token classification memo (MiFID II / MiCA / US tests)

- Token & project structuring (jurisdiction, SPV / fund / token model)

- Core token legal documents (Token Terms, White Paper, Subscription)

- Smart-contract & technical architecture advisory

- SPV / issuer incorporation in chosen jurisdiction

- Compliance & AML / KYC framework (policies, investor onboarding)

- Primary issuance support (investor flow, documentation, delivery)

- Multi-jurisdiction legal opinion (EU / US / offshore)

- Custody & banking setup (custodian, EMI / bank accounts)

- Secondary market & 6-month post-launch support

Premium

For institutional RWA platforms that need full multi-jurisdictional setup

- Regulatory & token classification memo (MiFID II / MiCA / US tests)

- Token & project structuring (jurisdiction, SPV / fund / token model)

- Core token legal documents (Token Terms, White Paper, Subscription)

- Smart-contract & technical architecture advisory

- SPV / issuer incorporation in chosen jurisdiction

- Compliance & AML / KYC framework (policies, investor onboarding)

- Primary issuance support (investor flow, documentation, delivery)

- Multi-jurisdiction legal opinion (EU / US / offshore)

- Custody & banking setup (custodian, EMI / bank accounts)

- Secondary market & 6-month post-launch support

What is RWA Tokenization?

Tokenization creates blockchain-based tokens that represent ownership or rights to real-world assets. These tokens can be traded 24/7 and fractioned into small parts, making traditionally illiquid assets like real estate, art, or gold more accessible and easier to transfer, with ownership and payouts automated via smart contracts.

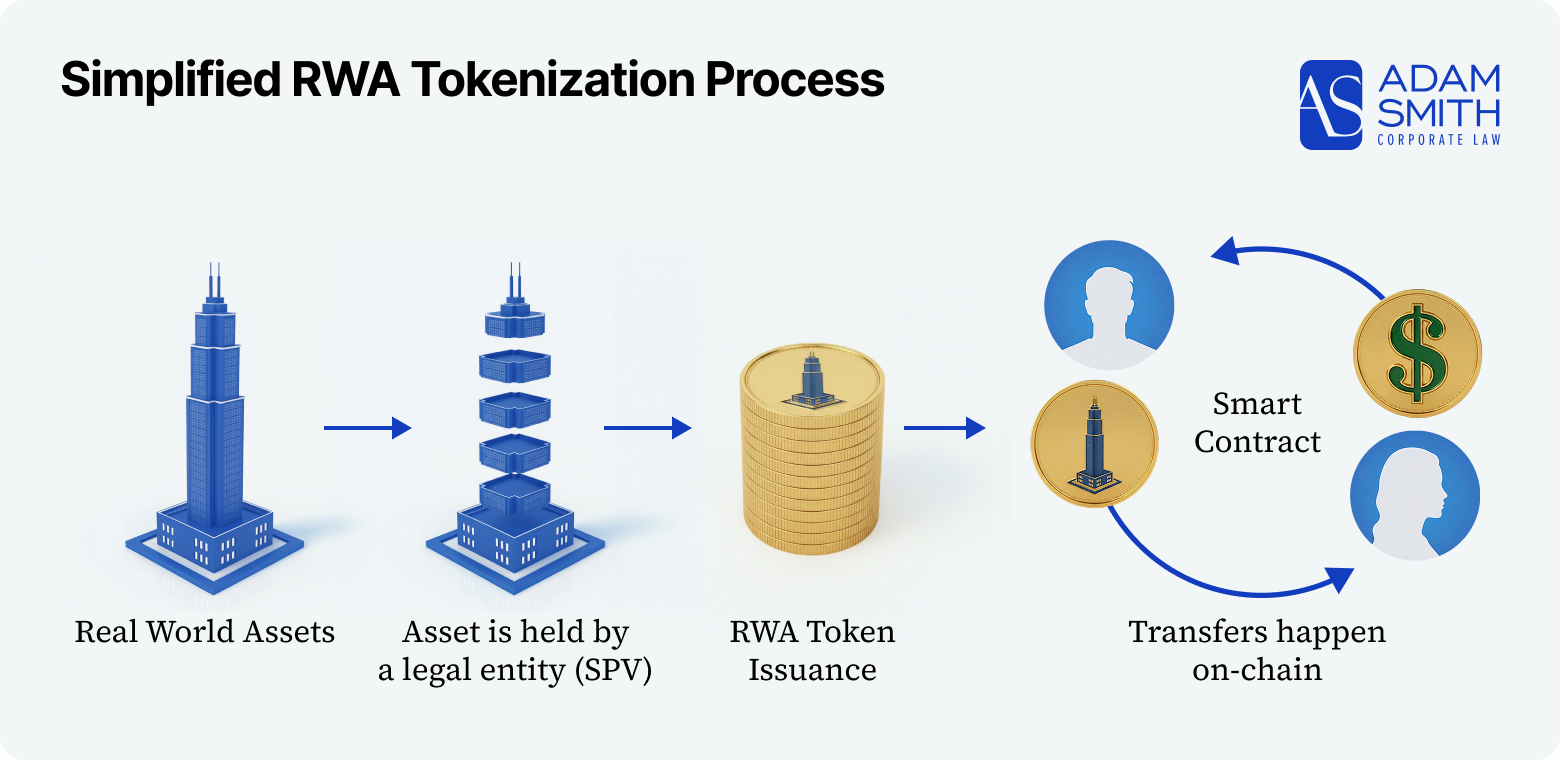

How Tokenization Works

Legally robust RWA structures usually follow this model:

- Asset is held by a legal entity (SPV) — A Special Purpose Vehicle company is formed to own the specific asset

- Tokens represent claims against the SPV — Investors hold tokens that represent shares, profit rights, or debt claims in the SPV

- Smart contracts automate distributions — Income (rent, interest, royalties) is distributed automatically to token holders

- Transfers happen on-chain — Token ownership changes via blockchain transactions, with legal rights following the token

A blockchain record alone does not automatically equal legal ownership of a real-world asset

Transfer of many assets (real estate, vehicles, IP rights) still requires off-chain legal steps like notarized deeds or registry updates. The token must be structured as a legally enforceable claim — either representing a membership interest in the SPV, or a contractual right to distributions.

RWA Tokenization Launch Roadmap

- 1

Token type, legal wrapper & jurisdiction definition

2 weeksBased on the asset class (real estate, credit, commodities, IP, etc.) the token is classified (security, MiCA-regulated crypto-asset, fund or commodity), investor rights and target investor groups are defined, and the core regulatory regimes are selected

- 2

Issuer (SPV or fund vehicle) incorporation

1 monthThe company or fund that will hold the assets and issue the tokens is incorporated, with governance and substance aligned to the applicable regulation and overall tokenization structure

- 3

Legal documentation preparation

from 1 weekToken Terms, White Paper, Subscription and shareholder documents are drafted so that the rights, restrictions and offering mechanics are fully captured in legally binding form.

- 4

Technical solution design & build

3-8 monthsTogether with the project’s development team or a tokenization provider, the smart contracts and/or tokenization platform are designed and developed (or configured) in line with the legal documentation and compliance requirements.

- 5

First compliant token issuance

3-8 monthsUsing the issuer entity together with the already deployed smart contracts or configured platform, investors are onboarded under AML/KYC, agreements are executed, funds are accepted, and tokens are minted and delivered under applicable exemptions or registrations.

- 6

Custody, banking & secondary market connections

Custodians and EMI/banks are integrated, and legally compliant access to secondary trading venues is set up where possible

Need legal support for RWA tokenization? Speak with our experts within 24h

Book a discovery call to discuss your project. We'll analyze your requirements and recommend the optimal legal structure.

RWA Tokenization in Early 2026: Key Regulatory Shifts for Asset Owners

By early 2026, RWA tokenization has moved from a grey zone to a regulated space in the EU and other leading jurisdictions. For asset owners planning tokenization in 2026, several shifts are especially important:

Clear token classification in the EU

With MiCA fully in force and supervisors publishing guidance through 2024–2025, most RWA tokens are now clearly treated either as securities or as Asset-Referenced / E-Money Tokens, triggering formal whitepaper, reserve and issuer authorization requirements instead of “best-effort” structuring.

Electronic / DLT securities as the default route

Regimes like Germany’s eWpG, the EU DLT Pilot and Switzerland’s DLT Act, refined by 2025, have made it standard by 2026 to structure many RWA deals as electronic / DLT securities on licensed infrastructure rather than as informal “utility” tokens with economic rights.

Licensed infrastructure instead of DIY

Enforcement trends in the EU, US and Singapore in 2024–2025 have pushed trading, custody and issuance of RWA tokens onto licensed CASPs, investment firms, banks and ATS/MTFs; by 2026, asset owners generally access markets through such regulated platforms rather than building unlicensed in-house rails.

Compliance, reserves and transparency by design

Post-MiCA rules for ART/EMT, as well as US and Swiss practice, now expect full AML/KYC, robust custody, clear disclosure of underlying assets and, where relevant, reserve and reporting regimes; in 2026, a “smart contract + marketing” approach without these layers is no longer acceptable for serious RWA products.

Jurisdiction- and investor-specific structuring

As MiCA, eWpG, DLT Pilot and stricter SEC practice crystallized through 2024–2025, it became clear that one unrestricted RWA token “for everyone everywhere” conflicts across regimes; by 2026, projects must define target investor types and countries and then tailor issuer location, licenses and offering terms to those specific regulatory frameworks.

Asset Classes: Real Estate, Commodities, IP & Beyond

Different asset classes require different legal wrappers, licenses, investor restrictions, and custody setups. Below is a short overview for each class, followed by a compact comparison table.

| Asset class | Legal Structure | Custody | Regulation |

|---|---|---|---|

| Real Estate | SPV or fund owns property; tokens = equity or debt in that vehicle. | Title stays in land registry; SPV holds asset and rent / sale proceeds. | Securities (MiFID/SEC), sometimes fund regulation, plus local property law. |

| Commodities (e.g. gold) | SPV or issuer holds title to metal; tokens mirror warehouse receipt or contractual claim. | Licensed vault, segregated and insured, with regular audits and reconciliation. | Commodities / financial regulation; may qualify as security or MiCA ART in the EU. |

| IP & Royalties | SPV or royalty vehicle holds or licenses IP; tokens = share in royalty or licensing income. | Rights recorded in contracts and IP registries; no physical asset. | Often treated as securities; portfolio deals may trigger fund rules. |

| Equities & Debt | DLT-native securities or traditional instruments wrapped by tokens; sometimes via RAIF, ICAV, AIF or SPV. | Recorded in CSD / DLT registers and held with licensed banks, brokers or custodians. | Full capital-markets framework (MiFID/Prospectus/CSDR, SEC) plus DLT rules (eWpG, DLT Pilot). |

| Art & Collectibles | SPV or fund owns artworks, wine, cars, etc.; tokens = fractional interest in that vehicle. | Stored with specialized custodians (galleries, vaults, bonded warehouses) under insurance / inspection. | Fractional interests generally treated as securities; cultural / export / insurance rules may apply. |

Real Estate

Example: RealT tokenizes US residential properties via Delaware or Wyoming LLCs, offering Reg D and Reg S tokens that represent membership interests in property SPVs; in Europe, several issuers use Luxembourg or German fund or note structures for tokenized real-estate portfolios.

Structure & custody: Local SPV or real-estate fund holds the property; tokens represent equity, profit-participation or secured debt. Title remains in the land registry; the SPV owns the asset, with bank accounts for rent and sale proceeds.

Regulation: Almost always securities (MiFID and Prospectus Regulation in the EU and SEC rules in the US) and sometimes funds (AIFMD or local RE fund regimes), plus local property/tax law.

Investors: Typically professional / qualified investors via private placements; retail access is possible only under full securities regimes (prospectus, Reg A+-style offerings, ELTIF-type products) with heavier disclosure and protections.

Commodities (e.g. gold)

Example: Paxos Gold (PAXG) and Tether Gold (XAUT) each represent one troy ounce of vaulted gold per token, backed by bar lists and redemption mechanisms with regulated custodians in London or Switzerland.

Structure & custody: Issuer or SPV holds title to the commodity in a licensed vault; tokens mirror warehouse receipts or contractual claims. Physical metal is segregated, insured and audited.

Regulation: Supervision by commodities and financial regulators; depending on design, tokens may be treated as a security, investment product or MiCA ART in the EU.

Investors: Fully KYC’ed investors, sometimes with access limited to professional or institutional clients; retail structures are possible where the product is duly authorized and offered under a full disclosure regime.

IP & Royalties

Example: The 2023 Rihanna “Bitch Better Have My Money” drop with anotherblock sold 300 NFTs linked to a share of streaming royalties, giving holders contract-based income rights without transferring copyright ownership.

Structure & custody: SPV or royalty vehicle holds or licenses IP; tokens give a contractual right to a share of royalty or licensing income. Rights exist in contracts and IP registries; no physical asset.

Regulation: High likelihood of “security” classification by securities regulators; portfolio deals may also trigger fund regulation.

Investors: Usually aimed at professional / high-net-worth investors buying exposure to future cash flows, not the IP asset itself; retail is possible only under full securities offering regimes with prospectus-level disclosure.

Equities & Debt (bonds, notes, fund units)

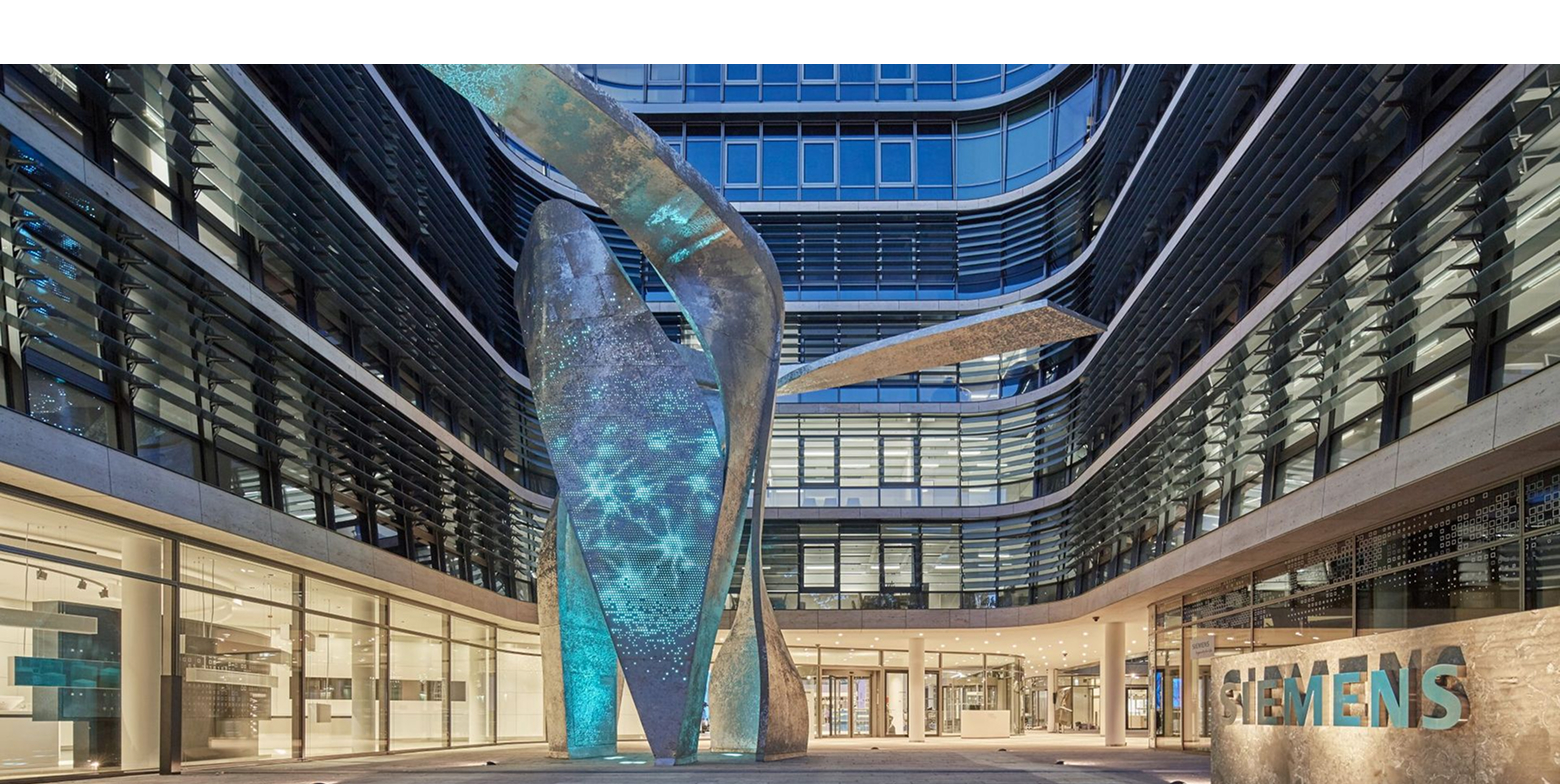

Example: Siemens issued a €60m tokenized bond on a public blockchain under Germany’s eWpG, and products like Franklin Templeton’s BENJI tokenized money-market fund and Ondo Finance’s OUSG give KYC’ed investors on-chain exposure to US Treasuries.

Structure & custody: On-chain native security in a DLT register, or traditional security wrapped by a token; sometimes via RAIF/ICAV/AIF/SPV. Securities are booked in licensed CSDs or DLT registers and held with licensed custodians.

Regulation: Fully within capital-markets regimes (MiFID, Prospectus Regulation and CSDR in the EU, and SEC rules in the US) plus DLT frameworks (eWpG, DLT Pilot).

Investors: Typically professional / institutional investors or participants in specific regimes (Reg D, ELTIF or RAIF, etc.); wider retail access requires full prospectus / Reg A+-style approvals and investor protections.

Art & Collectibles

Example: Masterworks.com acquires blue-chip artworks into individual US LLCs and offers SEC-qualified Reg A+ shares (sometimes mirrored as tokens), giving investors fractional economic exposure to the eventual sale price of each painting.

Structure & custody: SPV or fund owns artworks, wine, cars, etc.; tokens represent fractional interest in that vehicle and its proceeds. Physical items are stored with specialized custodians under insurance and inspection regimes.

Regulation: Fractional interests are generally treated as securities; sometimes there are additional cultural property, export and insurance rules.

Investors: Commonly targeted at affluent / professional investors, with limited or no retail access; retail offerings are possible only under full securities regimes with strong valuation, governance and disclosure standards.

Need legal support for RWA tokenization? Speak with our experts within 24h

Book a discovery call to discuss your project. We'll analyze your requirements and recommend the optimal legal structure.

Core RWA Structuring Models

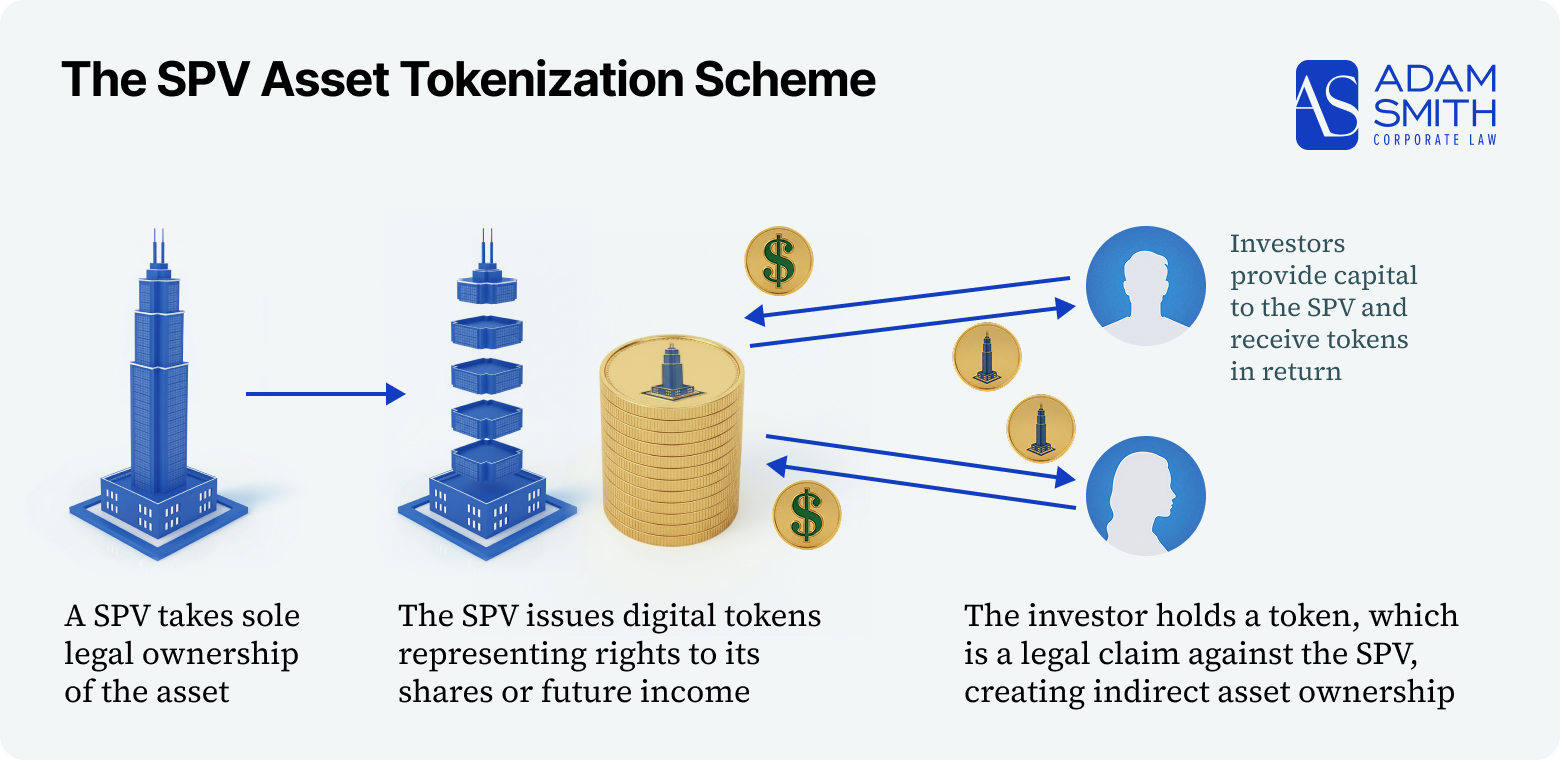

1. SPV → Token Holder (Equity or Debt)

This is a common model for single-asset real estate, art, and many commodity structures.

- Asset to SPV: The real-world asset is legally transferred so that the SPV (a company created just for this purpose) is the sole owner.

- Token Creation: The SPV creates digital tokens. These tokens act as digital certificates representing either part-ownership of the SPV (shares) or a right to its future income (debt).

- The Exchange: An investor sends money to the SPV and receives these tokens in return.

- Final Result: The investor owns the token, not the asset directly. The token gives the investor a legal claim against the SPV.

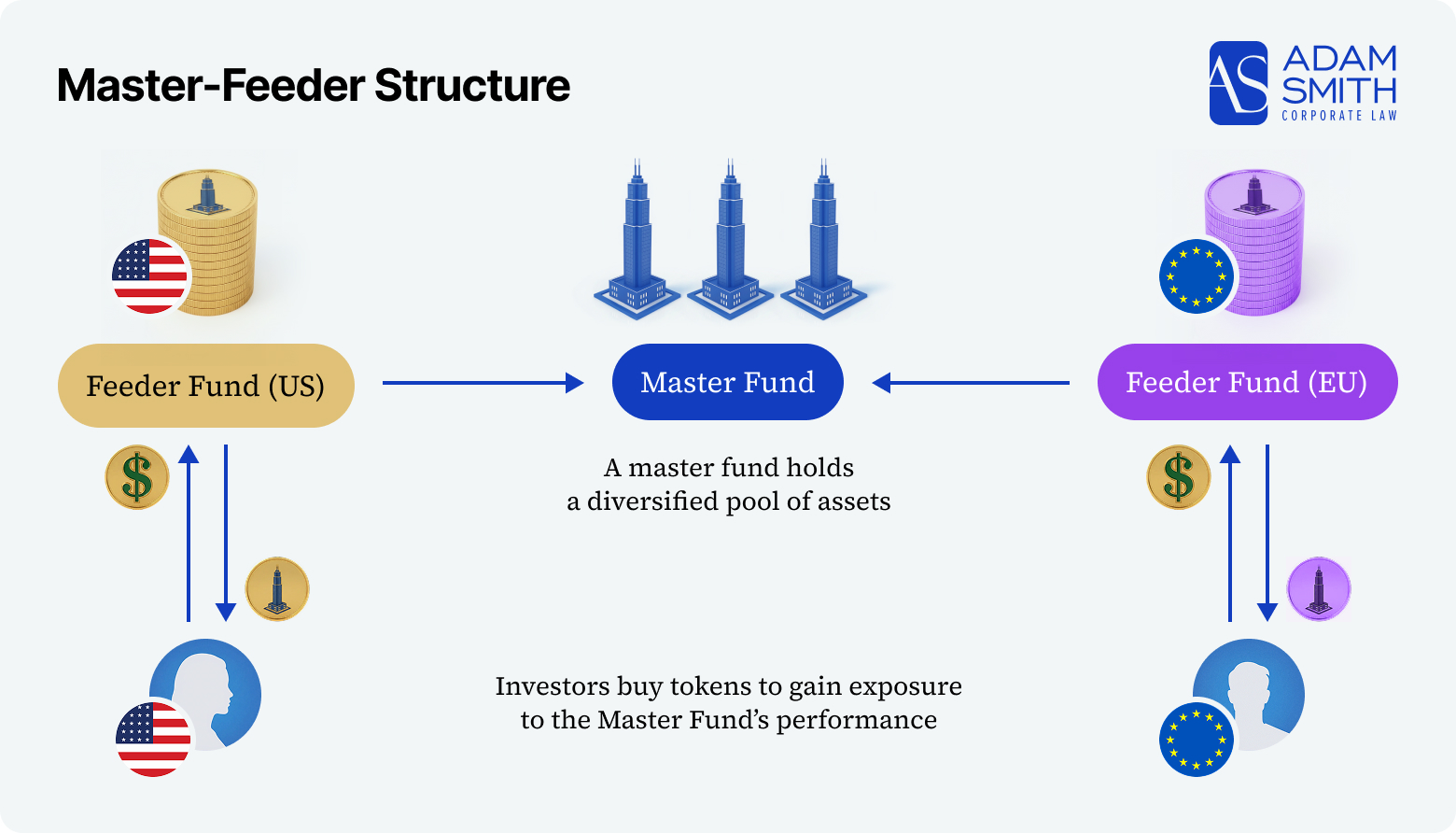

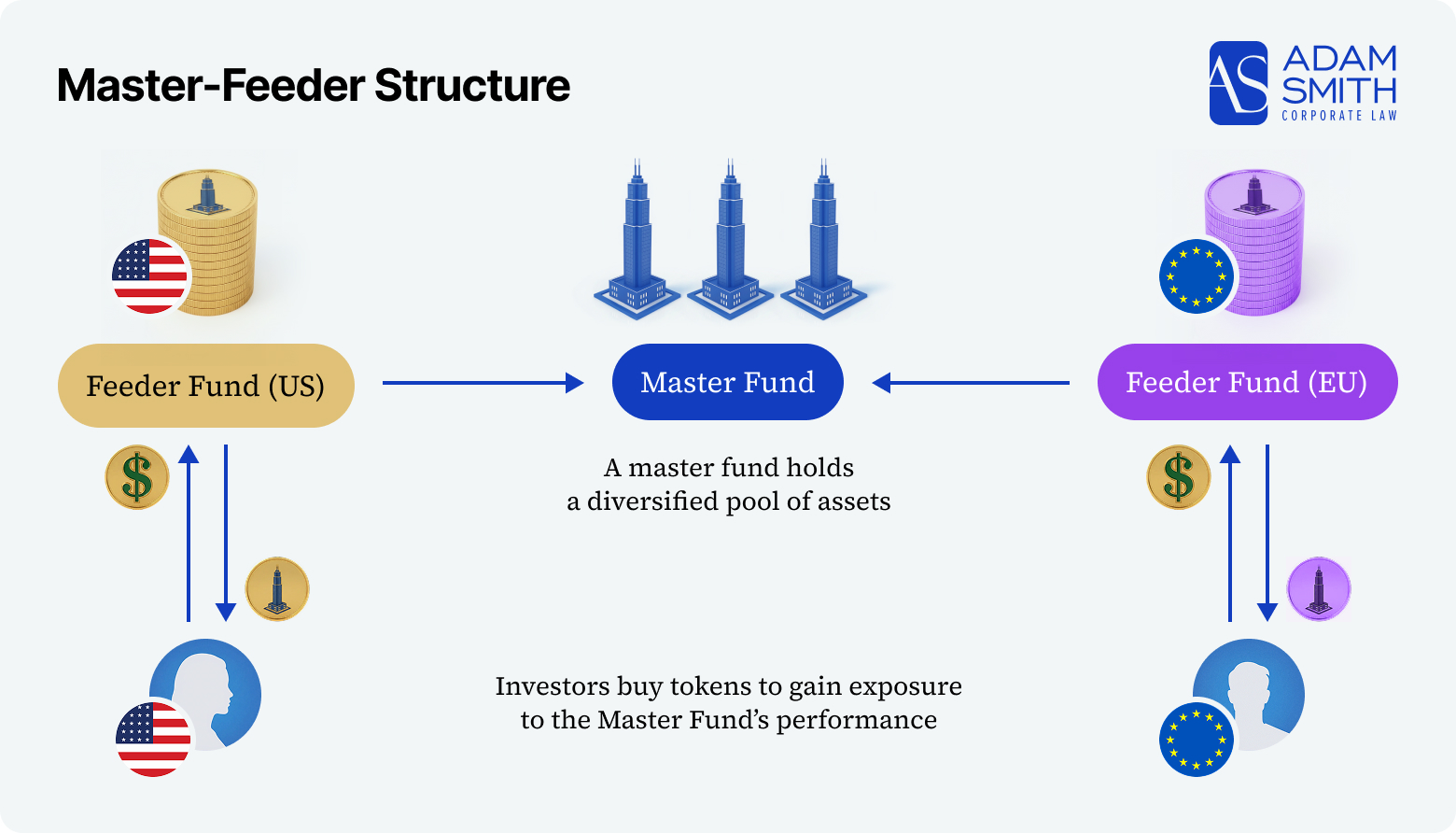

2. Fund → Feeder → Master → Tokenized Shares

- Asset Pooling (Master Fund): A central “Master Fund” is established to hold and manage the actual portfolio of diversified assets (e.g., US Treasuries, corporate credit, or real estate).

- Investor Access (Feeder Funds): Smaller “Feeder Funds” or SPVs are set up in specific jurisdictions (e.g., one in the EU, one in the US). These feeders exist only to funnel capital from local investors into the Master Fund.

- Tokenization: Instead of traditional paper certificates, the Feeder Funds issue digital tokens. These tokens represent a unit of ownership in the feeder, which in turn owns a slice of the Master Fund.

- Distribution: Investors buy these tokens to gain exposure to the Master Fund’s performance. This allows institutional managers to reach global investors while keeping legal and tax requirements separate for each group.

3. Claim-Based Token Model

For an Asset Owner (e.g., a real estate developer or a business owner), the Claim-Based Token Model functions primarily as a financing tool—similar to a loan or a revenue-share agreement—rather than a sale of the business.

- Retention of Legal Title: The Asset Owner maintains direct ownership of the physical or intellectual asset. The asset remains on the Owner’s balance sheet, avoiding the need for a complex transfer of title to a third party.

- Contractual Commitment: The Asset Owner enters into a master agreement with an Issuer (Platform/Bank). This contract formalizes an obligation to divert specific economic benefits (such as rental income, interest, or a percentage of revenue) to the Platform.

- Operational Control: The Owner retains full management and voting rights. Because the tokens represent a contractual claim rather than equity, the token holders function as creditors rather than partners and have no influence over the Owner’s business decisions.

- Revenue Distribution: Once the asset generates income, the Owner transfers the designated funds to the Platform. The Platform then utilizes blockchain technology to automate payouts to the individual token holders.

- Final Settlement: Upon the sale of the asset or the end of the contract term, the Owner fulfills the final “redemption value” defined in the contract, effectively closing the claim and retiring the tokens.

On-Chain Registry vs Off-Chain Legal Wrapper

Note: Each of the above models can be implemented either with an on-chain legal register or with a traditional off-chain register (CSD, company register, notary) and a token wrapper that represents an interest in that off-chain instrument. The choice determines where the “real” ownership record lives and which infrastructure and licenses you will need.

After choosing which of these models best matches your asset and investor base, you can then decide where to incorporate the issuer or fund (Delaware, Cayman, Luxembourg, etc.) and which regulated platforms and custodians to connect.

Need legal support for RWA tokenization? Speak with our experts within 24h

Book a discovery call to discuss your project. We'll analyze your requirements and recommend the optimal legal structure.

Jurisdictions & Legal Structuring Options

The table below compares common jurisdictions and wrappers used for RWA tokenization projects. Price is a relative indication of legal and infrastructure cost (including fund/issuer setup, licensing and mandatory service providers), not a binding quote.

| Jurisdiction | Best For | Key Framework / Wrapper | EU Passporting | Price |

|---|---|---|---|---|

| Estonia | EU-based SPV / issuer for RWA tokenization (lean setup, remote governance, startup-friendly) | Private limited company (Osaühing, OÜ) used as SPV; 0% tax on retained profits; e-Residency / remote administration; flexible share classes and tokenization-ready corporate structuring | Indirect (EU entity; passporting depends on wrapper/offer regime) | $$ |

| Luxembourg | Tokenized funds raising EU institutional and semi-retail capital | RAIF or SIF, often with ELTIF 2.0 label; DLT-compatible fund units | Yes | $$$ |

| Ireland | Institutional tokenized funds with tax-transparent vehicles | ICAV / QIAIF structures; often used as EU feeder or master funds | Yes | $$$ |

| Germany | Tokenized bonds and securities for EU professional investors | eWpG electronic and “crypto” securities regime; BaFin-supervised offerings | Yes | $$$ |

| Switzerland | Cross-border institutional RWA issuance with strong legal clarity | DLT Act (ledger-based securities), SDX and other licensed DLT venues | No (EEA bilateral only) | $$$ |

| Cayman Islands | Global non-US RWA funds and master–feeder structures | Segregated Portfolio Company (SPC) under funds law plus VASP regime | No | $$$ |

| Liechtenstein | Tokenization platforms and infrastructure with EEA access | TVTG “token container model”; service provider licensing with EEA passporting | Yes (EEA) | $$ |

| Delaware (US) | US-focused funds and SPVs raising accredited investor capital | Series LLC or LP with Reg D / Reg S offerings; familiar to US institutions | No | $$ |

| Offshore OpCo (Panama, Seychelles, BVI) | Pilot/MVP projects with local or friendly users; not for scaling | Simple company (IBC / LLC) issuing tokens without full fund regime | No | $ |

U.S.-Based Fund Structure (Delaware Series LLC)

Best suited for US-focused RWA funds and SPVs raising capital from accredited and institutional investors under familiar US fund law.

Delaware Series LLC is a familiar US fund wrapper for institutional capital and accredited investors. A parent LLC can create segregated series, each holding a different asset (real estate, credit, RWA portfolios), so multiple tokenized compartments sit under one umbrella without cross-liability. The structure works well with Reg D / Reg S private fund exemptions and typically has good access to US banks and custodians.

Offshore Fund Structure (Cayman SPC)

Best suited for global non-US RWA funds and master–feeder structures targeting qualified or institutional investors in a tax-neutral offshore environment.

Cayman SPC is a standard offshore fund vehicle for global non-US qualified investors: one company with segregated portfolios, no direct taxation and a regime well known in the hedge and alternative fund world. It does not shield you from US/EU securities law — US persons still require Reg D / Reg S — so it is usually used for non-US qualified or institutional capital rather than US retail.

EU Tokenized Funds (Luxembourg RAIF, Irish ICAV)

Best suited for EU-regulated tokenized funds that need passporting to institutional and semi-retail investors via established fund regimes.

Luxembourg RAIF and Irish ICAV/QIAIF are the main EU wrappers for tokenized RWA. RAIF offers relatively fast setup and flexible strategy (often combined with ELTIF 2.0), while ICAV/QIAIF is favored by institutions for tax efficiency and a mature service ecosystem. Both sit within the AIFMD/UCITS framework, provide EU-wide passporting, and plug into existing depositary, auditor and DLT-compatible registrar infrastructures.

Estonia (OÜ SPV) — EU issuer / SPV layer

For projects that don’t need a full regulated fund wrapper on day one, an Estonian private limited company (OÜ) is often used as a clean EU SPV to hold the asset and issue tokens. It is EU-based, can be managed remotely (incl. via e-Residency), offers 0% tax on retained profits, and supports flexible corporate structuring (share classes, economic rights, transfer restrictions, whitelist/KYC rules) — making it a practical “European SPV” option alongside RAIF/ICAV.

- 0% tax on retained earnings: tax usually applies on distribution (e.g., dividends), not while profits stay inside the SPV.

- Limited liability perimeter: investors/founders’ risk is limited to their contribution.

- Fast setup + remote administration: company processes are designed for online management (incl. e-Residency).

- Tokenization-friendly corporate setup: share classes, economic rights, transfer limits, whitelist/KYC, distribution rules.

Note: In many SPV models, tokens represent a contractual claim against the SPV (income / redemption rights), not direct ownership of the underlying asset—so investor protection depends heavily on the quality of the issuance terms and documentation.

Pure Offshore Operating Company

Only suitable for low-budget MVPs or highly local projects where speed and cost matter more than regulatory acceptance or institutional capital.

An offshore operating company in Panama, Seychelles or BVI is the cheapest and fastest way to issue tokens without a fund structure, but sits in a regulatory grey zone: it offers low setup cost and minimal disclosures, yet provides little protection against US/EU enforcement, is unattractive to institutional investors and banks, and is not a viable option for scaling.

Need legal support for RWA tokenization? Speak with our experts within 24h

Book a discovery call to discuss your project. We'll analyze your requirements and recommend the optimal legal structure.

Risks & Compliance: 2026 Owner Checklist

For asset owners, RWA tokenization in 2026 is primarily a regulatory and execution challenge. The points below focus on what you must get right before issuing any tokens.

Top Risk Areas & How to De-Risk Them

Regulatory classification & jurisdiction

In the EU (MiCA, eWpG), US (SEC rules) and hubs like UAE or Singapore, most RWA tokens are treated as securities or regulated crypto-assets.

- Obtain written legal opinions in each target market, define exactly which investors and countries you will serve, and issue via an SPV or fund in a jurisdiction with mature tokenization rules instead of trying to sell “everywhere”.

Custody, title & asset segregation

If the custodian or issuer fails, unclear segregation can leave token holders as unsecured creditors.

- Use regulated, insured custodians; keep assets off the operating company balance sheet in segregated SPVs or trusts; require regular third‑party audits and public proof‑of‑reserves.

Smart contracts, oracles & operational resilience

Contract bugs, key compromise, bridge failures or oracle manipulation can freeze assets, mis-price NAV or block redemptions.

- Use audited, standardized token frameworks (e.g. ERC‑3643 / ERC‑1400 with transfer controls), multi‑sig administration, real‑time monitoring and an incident response playbook aligned with bank‑grade resilience expectations (DORA-style).

Liquidity & valuation mismatch

Tokenization alone does not create liquidity; thin markets and stale appraisals can trap investors and force distressed redemptions.

- Validate demand before launch (named anchor investors or market makers), define clear lock‑ups and redemption terms, publish frequent NAV and asset reports, and build in gates or caps for redemptions.

Legal enforceability & cross-border disputes

Courts recognize contracts and corporate law, not just on‑chain balances.

- Make tokens explicit claims on an SPV or trust (equity, notes or revenue share), ensure token terms mirror smart‑contract logic, choose governing law in a strong jurisdiction, and specify arbitration or other dispute mechanisms in advance.

Frequently Asked Questions

RWA tokenization means creating blockchain-based tokens that represent legally enforceable rights to an underlying asset or pool of assets — for example equity or debt claims in an SPV, fund units, or contractual rights to cash flows. In practice, the asset sits with a company, fund or custodian, and the token is a digital representation of an interest in that legal structure, not the asset registry itself.

Most serious RWA tokens are either securities (shares, notes, fund units under MiFID II / SEC rules) or MiCA-regulated crypto-assets such as Asset-Referenced Tokens (ARTs) or E-Money Tokens (EMTs). Classification depends on what the token grants — ownership, profit-sharing, redemption rights — and on how it is offered and marketed. In our work, this classification and the resulting framework (MiFID vs. MiCA vs. US securities law) is always the first question answered.

The page covers the main RWA categories we see in practice: real estate, commodities (e.g. gold), IP & royalties, equities and debt instruments, and art & collectibles. Each of these has its own combination of wrappers (SPVs, funds, notes), custody model, regulatory regime and typical investor base, which is why the guide includes a dedicated comparison table for them.

Depending on the structure, an issuer can sometimes rely on private-placement exemptions and operate without a full license, especially for professional or qualified investors. However, running a platform, exchange or custodian, or issuing MiCA ART/EMT in the EU, usually requires authorization (VASP, investment firm, fund manager, e-money / payments license, or similar). A core part of any AdamSmith engagement is mapping which licenses are needed, and where exemptions are realistically available.

For EU-regulated tokenized funds, Luxembourg RAIF and Irish ICAV/QIAIF are common choices; for global non-US capital, Cayman SPC structures remain standard; for US-focused projects, Delaware Series LLC or LP structures are widely used; Switzerland, Germany and Liechtenstein are leading hubs for tokenized securities and infrastructure. The guide’s jurisdiction table summarizes when each option makes sense, whether EU passporting is available, and the relative cost level.

For projects that do not require new licenses, the realistic timeline is 4–8 months from initial regulatory analysis to first compliant issuance. If licenses or full fund authorization are required, the total timeline can extend to 12–18 months, driven mainly by regulator review. The implementation roadmap on this page breaks the process into phases: planning & analysis, entity formation & documentation, asset acquisition & custody, compliance & issuance, and post-launch operations.

Key risks include misclassification of the token (unregistered securities offering), being treated as an unlicensed fund or investment adviser, weak asset segregation or custody, gaps in AML/KYC and Travel Rule implementation, and cross-border distribution into jurisdictions with stricter rules (particularly US and EU). The “Key Legal Risks” and “Risks & Compliance Checklist” sections of this guide are designed as a practical de‑risking map for these issues.

Institutional-grade structures keep assets in segregated SPVs or funds, use regulated custodians or specialized vaults, and maintain dedicated bank or EMI accounts for cash flows. Investors and regulators increasingly expect title opinions, regular audits, proof‑of‑reserves reporting and clear policies for reconciliations and insurance. In the roadmap and risk sections, this is described as part of the “minimum compliance stack” before tokens are issued.

Liquidity typically comes from a mix of regulated trading venues (DLT MTFs, ATS), whitelisted OTC or peer‑to‑peer transfers between KYC’ed wallets, and in some cases listings on specialized RWA platforms. Simply minting a token does not create a liquid market: demand validation, market-maker arrangements, clear lock‑ups, and legally compliant access to secondary venues are all part of the structuring work described in this guide.

Our standard engagement follows the “AdamSmith RWA Tokenization Services” flow: discovery call, regulatory assessment and structure proposal, then entity formation, documentation, and if required, licensing support, followed by launch and ongoing advisory. Throughout, we align legal documents, smart-contract logic, custody, banking and investor onboarding so that the on-chain design matches enforceable off-chain rights.